The trading market is full of opportunities and risks. Recently, Australia's ASIC has frozen several websites that forged regulatory numbers, and the UK FCA has also blocked many deck companies. Platform risks may quietly emerge before traders enter the market. The phenomenon of black platforms is common, and the risks it brings to traders are shocking.

Common features of black platforms

False propaganda: Black platforms often attract traders by exaggerating propaganda, promising high returns, low risks, and even "risk-free" trading. Such propaganda lacks substantive evidence, usually just sounds gorgeous but without any guarantee.

Illegal qualifications: Black platforms usually lack legal financial licenses, or forge or steal the qualifications of other formal platforms to commit fraud. When choosing a platform, investors must verify their legality and qualifications.

Fund security cannot be guaranteed: Such platforms often require traders to transfer funds to private or illegal accounts rather than to trade through formal third-party payment channels. In this way, the safety of traders' funds cannot be effectively protected, and they may even face the risk of funds being swept away or being unable to withdraw.

For example, some "high-risk platforms" recently exposed openly forged regulatory licenses in many countries such as Cyprus, the United Kingdom, Vanuatu, etc. The official website information is suspected to be false, and the transaction software is not connected to regular terminals such as MT4/MT5. What’s more serious is that the platform does not have a physical office space and the location of the server is unknown. By applying multi-country license signs, the illusion of compliance is created, but in fact there is no fund isolation, no risk control mechanism, and even a lack of legal supervision.

The trading market is unfathomable, and many traders are confused by the platform's false promises when they lack market experience. Through repeated trial and error, traders often spend not only a lot of time and energy, but even face unnecessary capital losses. So, how can we avoid these traps and find a safe and reliable trading platform?

No deposit required, more assured

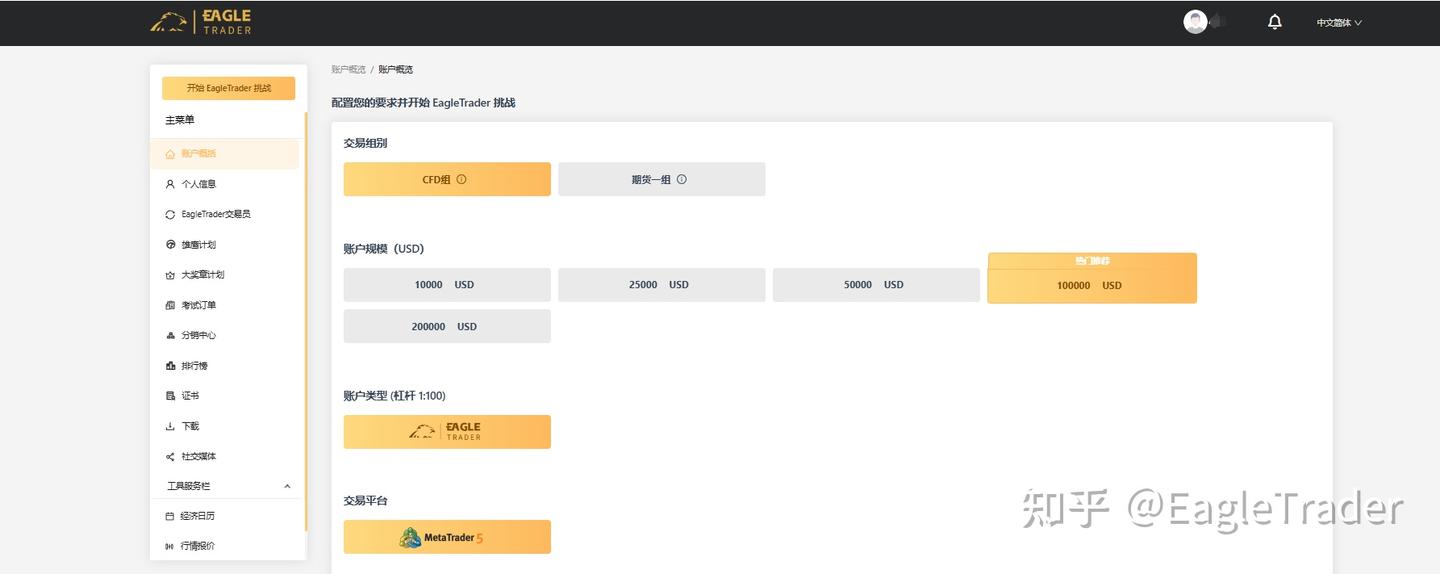

EagleTrader self-operated trading exam passes the simulated trading model and provides a trading environment without actual capital investment. Traders can get close to the truth by simply using simulated funds provided by the platform.Test your trading strategies and skills in a real-market environment. This approach greatly reduces the risk of funds and is especially suitable for traders with smaller funds or less familiar with the market.

The platform ensures that every trader's performance can be objectively evaluated through strict risk control mechanisms and audit processes. Qualified traders can not only get the opportunity to enter the profit-sharing stage through the exam, but also obtain a corresponding proportion of profit sharing based on their trading performance. This mechanism is designed to help traders improve their trading capabilities and support their future career development.

Risk Control and Audit Mechanism

EagleTrader platform has established a complete risk control mechanism to ensure that every trader can receive timely feedback during the simulated trading process, helping them discover potential problems and correct them. The platform's audit mechanism provides more opportunities for excellent traders. Qualified traders can enter the profit sharing stage and enjoy a profit sharing of up to 90%. This mechanism not only encourages traders to continuously improve their trading levels, but also allows them to gradually move towards professional trading.

Compared with the risk of exploding from traditional platforms, EagleTrader eliminates the hidden dangers of fund security through demo accounts, allowing traders to focus more on improving technology and optimizing strategies, thereby better responding to future market challenges.

Compliance Guarantee

In addition to a complete risk control and audit mechanism, EagleTrader also provides sufficient guarantees in compliance. The platform has licenses No. 4 and No. 9 of the Hong Kong Securities Regulatory Commission, ensuring its legal operation in the financial market. In addition, EagleTrader has also reached a cooperation with E-SignPau to ensure the safety and legality of the transaction signing process. These compliance qualifications provide solid legal support for the operation of the platform, ensuring the security of traders' funds and transparency in the trading process.

For traders, choosing a platform with compliance qualifications not only means that they can trade in a legal and compliant environment, but also enjoy higher legal protection and risk management.

In the trading market, the choice of a platform is crucial. Faced with many risks and uncertainties, choosing a compliant and secure platform is a key step to successful transactions. The simulated trading model of EagleTrader provides a relatively unique opportunity to greatly reduce fund security issues through different trading forms; urging transaction improvement issues through strict trading goals; and solving daily income issues through profit sharing incentives. For many traders, EagleTrader is really worth trying!

Incubate the world's top traders

Participate in 90% profit sharing